Too Big to Fail by Andrew Ross Sorkin is a gripping narrative of the 2008 financial crisis, offering a detailed account of Wall Street’s collapse and its aftermath.

1.1 Overview of the Book

Too Big to Fail by Andrew Ross Sorkin is a comprehensive account of the 2008 financial crisis, detailing the collapse of major financial institutions and the government’s response. The book provides an in-depth look at the key players, including Wall Street executives and political leaders, offering insights into the decisions that shaped the crisis. Sorkin’s narrative captures the chaos and urgency of the period, making it a definitive resource for understanding the events. Available in PDF, it remains a vital read for those interested in financial history.

1.2 Author Background: Andrew Ross Sorkin

Andrew Ross Sorkin is a renowned American journalist and author, best known for his work as a financial columnist at The New York Times. He is also the founder of DealBook, a platform covering business and finance. Sorkin’s reporting has earned him numerous accolades, and his book Too Big to Fail is widely praised for its detailed, behind-the-scenes account of the 2008 financial crisis, showcasing his expertise in investigative journalism.

Key Themes and Focus Areas

Too Big to Fail explores the 2008 financial crisis, highlighting systemic risks, Wall Street’s role, and government interventions, offering insights into the global economic turmoil and its consequences.

2.1 The 2008 Financial Crisis and Its Impact

The 2008 financial crisis, triggered by subprime lending and excessive risk-taking, led to the collapse of major institutions like Lehman Brothers and AIG. This caused widespread job losses, home foreclosures, and a global economic downturn. The crisis exposed systemic vulnerabilities, prompting unprecedented government bailouts and regulatory reforms. Its impact reverberated worldwide, reshaping financial markets and highlighting the fragility of the global economy.

2.2 The Role of Wall Street and Washington

Wall Street and Washington played pivotal roles in the 2008 crisis, with high-stakes negotiations and decisions shaping the outcome. Executives like Jamie Dimon and Hank Paulson navigated the collapse of institutions, while policymakers balanced bailouts with systemic risks. The interplay between financial leaders and government officials highlighted the delicate balance between saving the economy and protecting individual interests, revealing both collaboration and conflict during the crisis.

Main Characters and Institutions

Too Big to Fail highlights key figures like Jamie Dimon, Hank Paulson, and institutions such as Lehman Brothers and Goldman Sachs, detailing their roles in the financial crisis.

3.1 Prominent Figures in Finance and Politics

Too Big to Fail delves into the lives of influential figures such as Jamie Dimon of JPMorgan Chase, Henry Paulson, and Lloyd Blankfein of Goldman Sachs. Sorkin vividly portrays their roles during the crisis, highlighting their decision-making and the political dynamics at play. The book also focuses on Lehman Brothers’ CEO Dick Fuld, whose actions exemplify the high-stakes environment. These individuals’ stories reveal the human side of the financial collapse and its far-reaching consequences.

3.2 The Collapse of Major Financial Institutions

Too Big to Fail meticulously details the downfall of iconic financial institutions like Lehman Brothers, Bear Stearns, and Merrill Lynch. The book highlights how these collapses, particularly Lehman’s bankruptcy, sent shockwaves through the global economy. Sorkin also examines the near-failure of AIG, revealing the systemic risks and panic that gripped Wall Street. These events underscored the fragility of the financial system and the urgent need for government intervention to prevent further devastation.

The Author’s Approach and Research

Andrew Ross Sorkin employed rigorous investigative journalism and extensive interviews to craft a detailed narrative. His research captures the high-stakes decisions and struggles of Wall Street leaders.

4.1 Sorkin’s Investigative Journalism Methodology

Andrew Ross Sorkin’s investigative approach involved meticulous research and exclusive interviews with key financial figures. He gained unparalleled access to major players, capturing behind-the-scenes moments during the crisis. His methodology blended thorough fact-checking with narrative storytelling, providing a detailed and engaging account of the 2008 financial collapse and its aftermath.

4.2 Behind-the-Scenes Narratives and Insights

Andrew Ross Sorkin provides intimate, behind-the-scenes narratives of key financial figures and institutions during the 2008 crisis. His access to major players like Jamie Dimon and Henry Paulson offers unique insights into high-stakes decision-making. The book vividly captures the personal struggles and political maneuvering, humanizing the events and revealing the complexities of the financial system’s near-collapse.

The 2008 Financial Crisis in Detail

The 2008 financial crisis, detailed in Too Big to Fail, was the worst economic downturn since the Great Depression, triggered by subprime lending and the collapse of major institutions like Lehman Brothers.

5.1 Causes of the Crisis

The 2008 financial crisis, as detailed in Too Big to Fail, was rooted in subprime lending, deregulation, and a housing bubble. Banks issued risky mortgages to unqualified borrowers, which were then bundled into collateralized debt obligations (CDOs) and mortgage-backed securities (MBS). These instruments, often rated as safe, were sold globally, spreading risk. When housing prices collapsed, the value of these securities plummeted, leading to massive losses and a credit crisis.

5.2 Key Events and Turning Points

The collapse of Lehman Brothers in September 2008 marked a pivotal moment, triggering global financial panic. The US government’s bailout of AIG and the establishment of the Troubled Asset Relief Program (TARP) were critical interventions. These events underscored the fragility of the financial system and the need for unprecedented government action to prevent a complete economic collapse, as detailed in Too Big to Fail.

Government Intervention and Policy Responses

The 2008 crisis prompted unprecedented government actions, including the Troubled Asset Relief Program (TARP) and massive bailouts for banks and financial institutions to stabilize the economy.

6.1 Bailouts and Regulatory Measures

The 2008 crisis led to massive government bailouts, including the Troubled Asset Relief Program (TARP), which injected billions into failing institutions like Lehman Brothers and AIG. Regulatory measures were swiftly enacted to stabilize the financial system, sparking debates over moral hazard and long-term economic impacts. Sorkin’s account in Too Big to Fail provides a detailed look at these controversial interventions and their far-reaching consequences.

6.2 Controversies Surrounding Government Actions

The government’s response to the 2008 crisis, including massive bailouts, sparked intense debate. Critics argued that rescuing institutions like Lehman Brothers and AIG created moral hazard, encouraging risky behavior. Many questioned the fairness of intervening for large banks while leaving smaller firms vulnerable. Sorkin’s book highlights the public’s skepticism and outrage over perceived favoritism, as well as the long-term implications of these actions for the financial system.

Reception and Impact of the Book

Too Big to Fail received widespread critical acclaim, becoming a New York Times bestseller. Its detailed narrative and insider perspective made it a seminal work on the 2008 crisis.

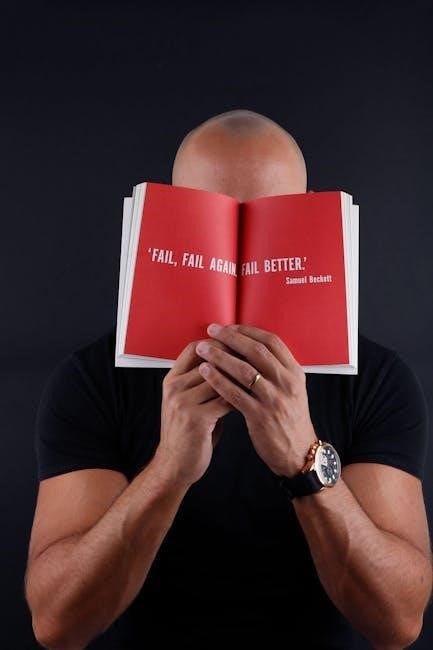

7.1 Critical Acclaim and Reviews

Too Big to Fail received widespread critical acclaim for its detailed narrative and insider perspective. Reviewers praised Andrew Ross Sorkin for delivering a gripping, moment-by-moment account of the 2008 financial crisis. The book was hailed as a definitive and seminal work, earning it a spot as a New York Times bestseller. Its ability to capture the complexities of the crisis and the personalities involved solidified its reputation as a must-read for understanding the financial meltdown;

7.2 The Book’s Role in Understanding the Crisis

Too Big to Fail serves as an essential resource for understanding the 2008 financial crisis, offering unparalleled insights into the interplay between Wall Street and Washington. Sorkin’s meticulous reporting and access to key figures provide a comprehensive narrative, making the complexities of the crisis accessible to both experts and general readers. The book’s detailed analysis has become a cornerstone for education and discussion on the subject.

Availability of “Too Big to Fail” in PDF Format

Too Big to Fail is widely available in PDF format on platforms like bdebooks.com, offering readers a convenient way to access Sorkin’s detailed account of the 2008 crisis.

8.1 Sources for Downloading the PDF

Too Big to Fail by Andrew Ross Sorkin is available in PDF format on various platforms. Websites like bdebooks.com and online libraries provide free or paid access to the book. Readers can also find it on Google Books or through academic databases. Ensure to download from reputable sources to avoid copyright infringement and access a high-quality version of the text.

8.2 Legal and Ethical Considerations

Downloading Too Big to Fail in PDF requires adherence to copyright laws. Unauthorized distribution or downloading from pirated sites is illegal and unethical. Purchasing from verified retailers or accessing through legal platforms ensures compliance with intellectual property rights, supporting authors and publishers ethically. Always opt for legitimate sources to respect the work of Andrew Ross Sorkin and the publishing industry.

Lessons Learned and Future Implications

Too Big to Fail highlights the fragility of financial systems and the dangers of unchecked risk-taking. It underscores the need for robust regulation and accountability to prevent future crises.

9.1 Financial Reform and Systemic Risk

Too Big to Fail exposes the vulnerabilities in the financial system, revealing how risky practices and lax oversight led to the 2008 crisis. The book emphasizes the urgent need for reform, highlighting the dangerous interplay between Wall Street and Washington. It underscores the importance of stronger safeguards to prevent systemic risks and ensure accountability, while addressing the challenges of institutions deemed “too big to fail.”

9.2 The Ongoing Debate on “Too Big to Fail” Institutions

Too Big to Fail reignites the debate over institutions deemed too large to fail, exploring their enduring influence and systemic risks. The book highlights concerns about their unchecked power and the potential for future crises. Sorkin examines the tension between free-market principles and government intervention, sparking discussions on whether such institutions remain a threat to economic stability and the need for continued regulatory reforms to mitigate these risks.